It is very important to note that a downswing of that size should not be taken lightly and would signal the beginning of a long bear market for most other assets. Bitcoin, on the other hand, is built a little differently and has seen pullbacks like this before during historic bull runs. That doesn’t mean that recent price action isn’t a cause for concern, but it does mean that this bull market likely isn’t quite over yet. It is interesting that crash priced as many institutions were showing interest in buying bitcoin….almost as if they were upset they missed BTC at a lower price and wanted another opportunity to buy cheaper… (but enough with the conspiracies)

$8.6 billion in longs were liquidated on that crash. It seems like people never learn their lesson. As long as traders continue to jump into using such high leverage so fast, crashes like this will continue to occur.

In hindsight, the intermediate top signals should have been obvious: people getting hilariously rich off dog-themed meme coins, celebrities publicly endorsing cryptocurrencies, and teachers and barbers talking about crypto to their clients and students. Again, it is always easier to spot these signals after the fact, but it is important to pay attention to overall sentiment and learn when things are a little too over-extended.

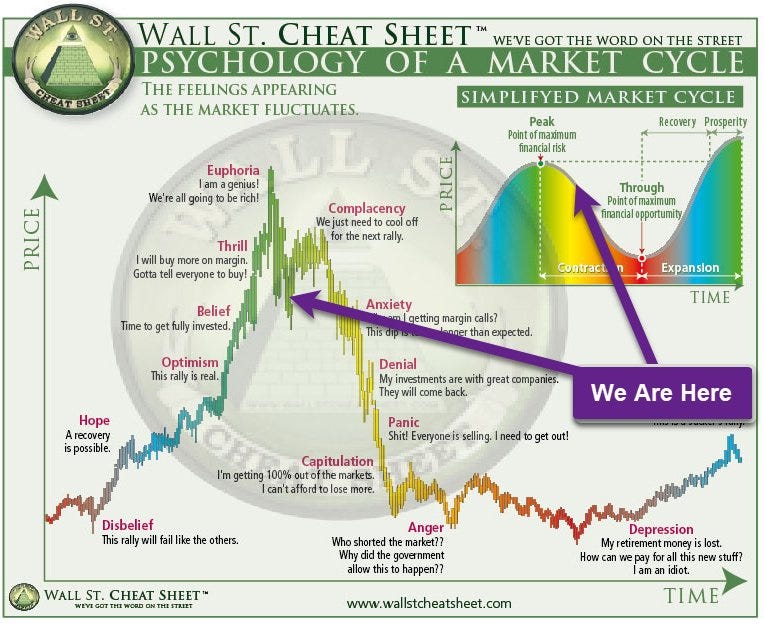

Psychology of a Market Cycle

This is a graph that is often used to describe the price action of assets through their market cycles. In particular, it is used very frequently with bitcoin, as bitcoin’s price tends to rise and crash seemingly out of nowhere.

Let me start by saying I didn’t make this graphic. I believe that this bull run will continue but it is always smart to look at the other side of things. If this graph makes you uncomfortable then it is probably best to de-risk, so that if it does play out you are not completely out of luck. It is important to be aware of the worst-case scenario.

It’s a good thing people are scared. We need over-leveraged, greedy traders to get liquidated. Only then will the price continue up.

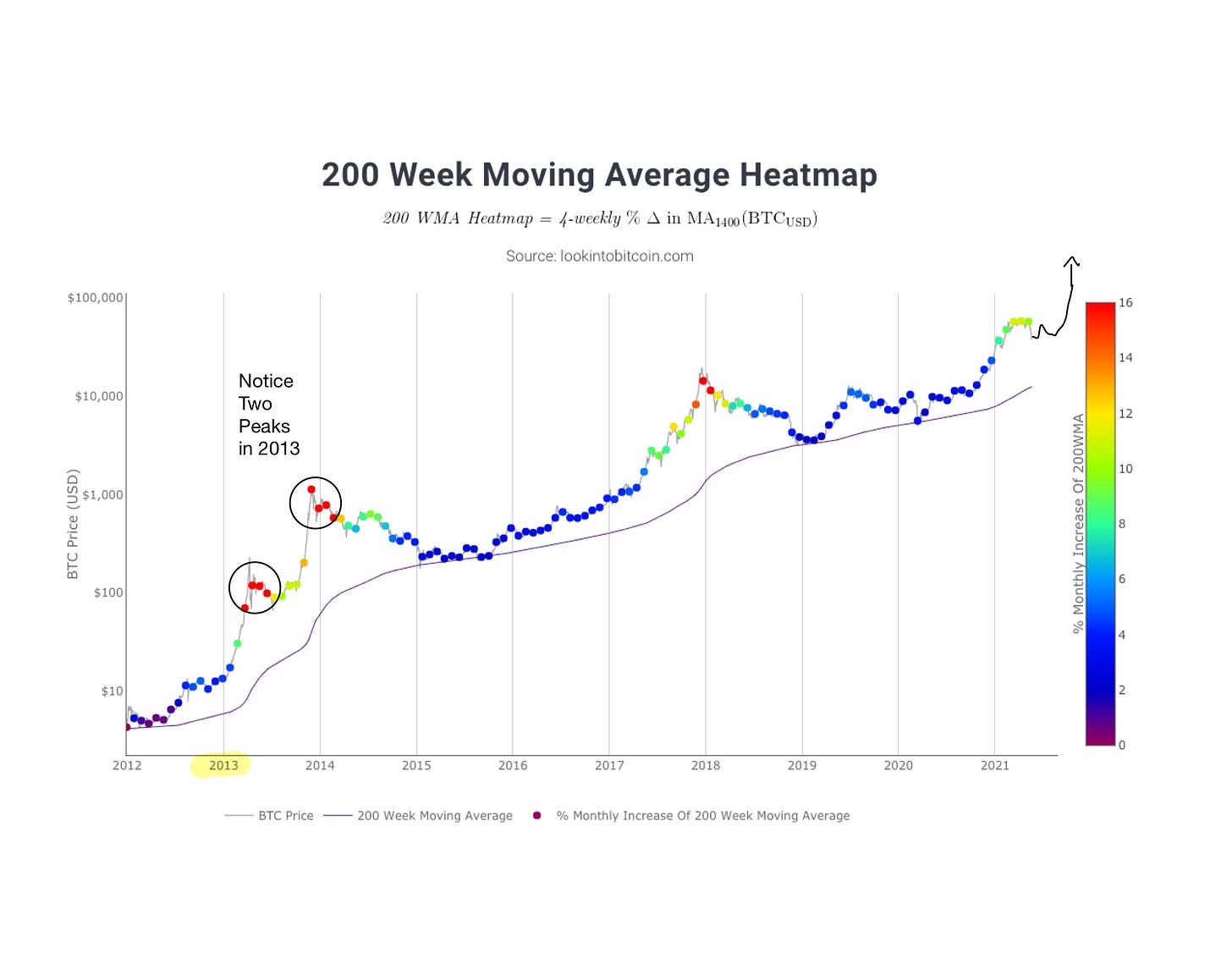

200-Week Moving Average Heatmap

With some better news, I have found this to be the most reliable indicator for bitcoin. This graph tracks the rate at which the 200 week moving average of Bitcoin changes. When the rate of change is high, the dots turn redder, when the rate of change is low, they’re blue. Every cycle of bitcoin so far has ended with a parabolic run in which the 4-week 200 MA has shown a rate of change of at least 14-16%. I believe that this cycle will be similar to the one that played out in 2013, with an intermediate top before another rise at the end of the year.

In 2013 there was a local high point at around this same time of year, followed by horizontal consolidation before another parabolic move at the end of the year.

Cryptocurrencies are very volatile, your entry point is everything. This is why it is so important to buy dips and take profits when the price has risen dramatically.

Bitcoin

BTC/USD Weekly Chart

If you’re looking for a bullish case for bitcoin, just zoom out. Bitcoin just barely touched the bottom support line on the weekly chart.

BTC/USD Daily Chart

Well, Bitcoin definitely crashed more than most people expected, myself included. I had moved the buy zone to the upper $30,000 range but of course, bitcoin crashed all the way down the $30k. I didn’t expect that, but I am not surprised one bit that bitcoin did something unexpected (it always does).

Price is currently just under the 200-day moving average, once that is flipped into support I will feel more confident with things.

Ethereum

Ethereum just touched off the top of the parallel trading channel it was in, as well as the supporting trend line. Overall things are still looking pretty good for ETH, although that could completely depend on what Bitcoin ends up doing. Price is also still comfortably above the 200 day MA, things are definitely not over for Ethereum yet.

Altcoins

I wouldn’t really suggest trying to trade many altcoins right now…their price action seems to be completely dependent on what bitcoin is doing at the moment. I am still very bullish on the DeFi space in general and think that now is a decent entry for many of those coins. I also still have my eyes on MATIC, SOL, and LTC.